Some People Have To Return Their $1,400 Stimulus Check, Are You One Of Them?

We’ve posted a lot about the stimulus checks with new information as we learn about it. Some of it has been quite confusing, and now there is a new update.

When President Biden signed the 1.9 trillion stimulus legislation that started the new disbursement of stimulus checks there were some things that happened.

Some people have to return their stimulus check. Yes, there were some mistakes that happened and people that did not qualify received a stimulus payment.

Who needs to return their stimulus payment

Somehow, nonresident aliens got a stimulus payment. A nonresident alien means they are not US citizens and have not been in the US long enough. They also don’t have a green card.

Those people did not qualify and some of them actually got a payment. Those payments need to be returned to the tax agency.

Keep in mind that there is a difference between nonresident aliens and qualifying resident aliens.

A qualifying resident alien has a valid Social Security number and may either have a green card, or they live in the US for a substantial time of the year.

There were also stimulus checks sent to married couples where one of the spouses had died. Those payments also have to be returned.

You will need to issue a letter explaining what happened. They can then issue a new payment in the correct amount for the living spouse only.

You don’t have to accept the stimulus payment

Another thing I learned was that if you do not need or want this third stimulus payment, you don’t have to keep it. You can send it back to the tax agency. I had no idea!

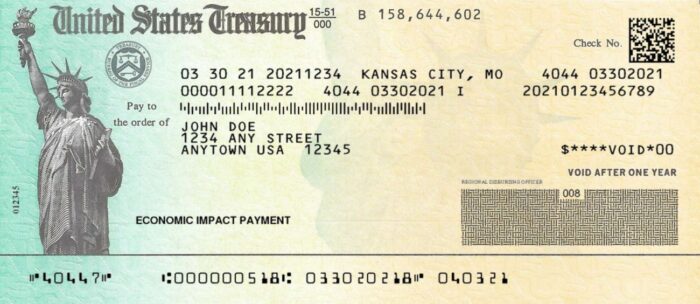

If you choose to send it back to the IRS, send your pre-loaded debit card they sent back to them. Also, include a letter explaining that you don’t want the money. Those can be sent to:

Money Network Cardholder Services, 2900 Westside Parkway, Alpharetta, GA 30004

If you received an actual check in the mail from the IRS, you can void the check. Then send it back to one of the IRS addresses found at the bottom of this page linked here.

Most people I know received the payment through direct deposit. To send that back you will need to make a check payable to the US Treasury. Be sure to include “Third EIP” and your taxpayer ID number somewhere on the check.

Be sure to include an explanation about why you’re sending it back. Those can also be sent to the same addresses that are used to mail the actual checks back (linked above).