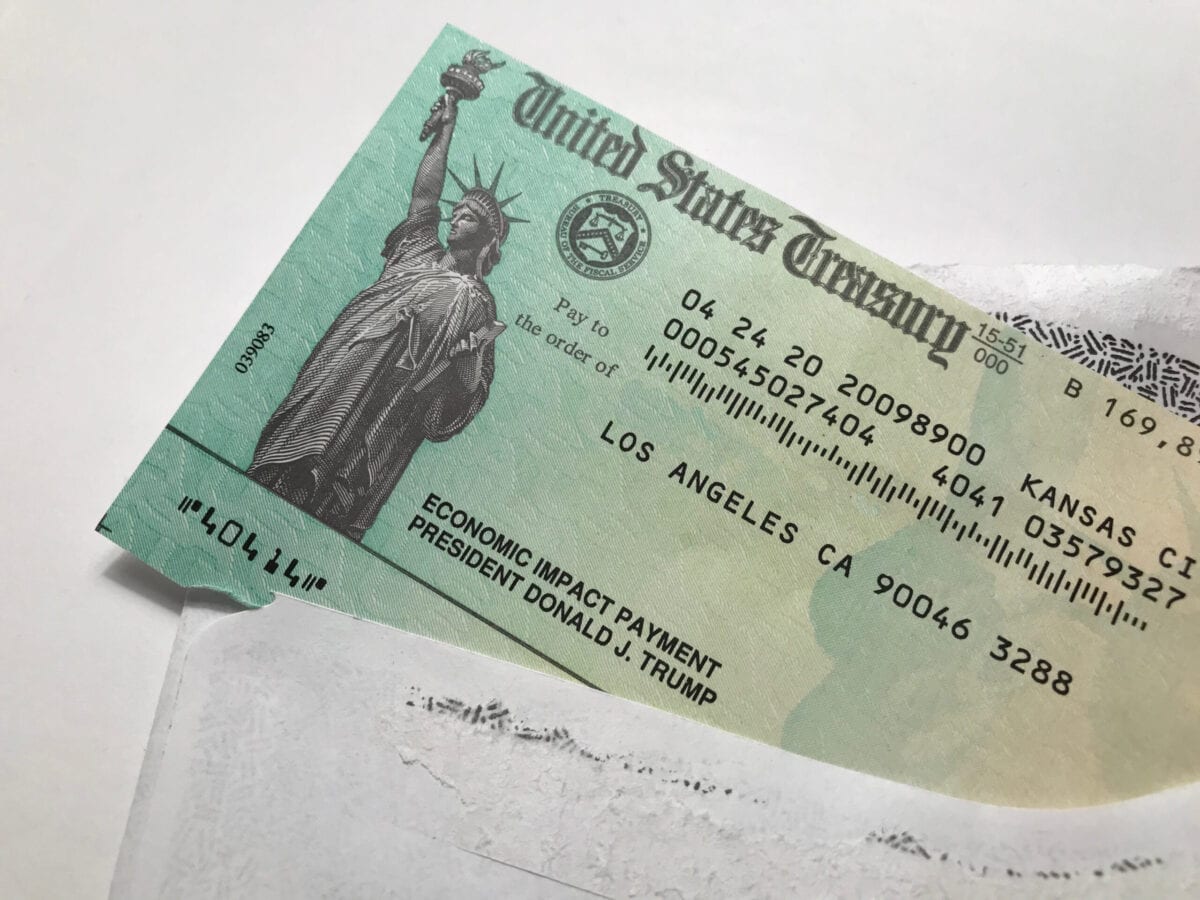

The IRS Just Launched A Tool You Can Use To Set Up Direct Deposit For Your $1,200 Check

Have you been stalking your bank account to see if your stimulus check has arrived? Me too.

Many families are waiting for their stimulus checks to arrive to help with simple things like groceries and bills.

With social distancing being in full affect, many have lost their jobs or have had to take a temporary leave, making this check crucial to some.

The IRS has now created a tool to allow you to put in your direct deposit information and banking information to ensure a faster way to receive your stimulus check.

This is for those that usually owe money for their taxes, and help the status of their stimulus check arrive quicker.

This tool will ask you personal information in order to ensure they give you the correct amount based on your income.

If you didn’t file taxes in 2018 or 2019, you will have to fill out a filing requirement to receive your payment.

You can also visit the Economic Impact Payments Information Center if you have further concerns about your stimulus check. There are able to answer any questions you many have!

Go to the IRS Stimulus Check Tool and update your payment preference and click “Get My Payment”. Be patient as the site is loading slow with so many trying to get on it.

We hope this helps many of you get your payment quickly and that it helps you during this trying time. Stay safe out there.

Am I gonna receive a stimulus check even though I’m on SSI

Am I gonna receive a stimucial check since I’m on ssi

Will I receive a check! I’m on social Security and do not file taxes,

Thanks

I am waiting for my check to go into my acct direct deposit has it been done yet checked the bank yesterday and they knew nothing abourt it, i have some bk bills to pay to get taken care of, its goes into my savings acct