If You Got Those Important Letters from The IRS and Are Confused, Here’s What You Need To Know

A few weeks back I told you all that the IRS would be sending you two letters in the mail that you cannot throw away. You need them to file your 2021 taxes.

Well, turns out, people are now getting them.

In fact, I just received one of the two letters today (letter 6419) and as soon as I opened and read them, I just knew people were going to be confused (because I sure was).

And here’s the thing, the IRS is so BUSY right now, when you call, you are put through this automated system, connected to someone who can’t answer your questions and then transferred to another department where the recording says “we are too busy to take your call right now please try again another day”. Ask me how I know… (it’s because I tried).

So, I am going to spare you all that headache…

What Do The IRS Letters Look Like?

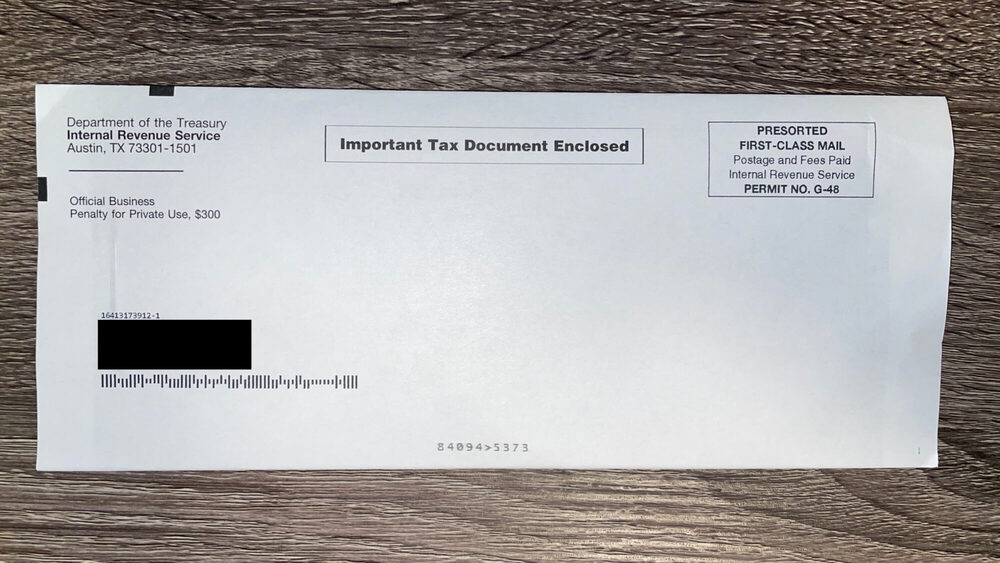

For starters, make sure you don’t throw this away because it kind of looks like junk mail. The IRS letter that contains letter 6419 comes in an envelope that looks like this:

What Does IRS Letter 6419 Look Like?

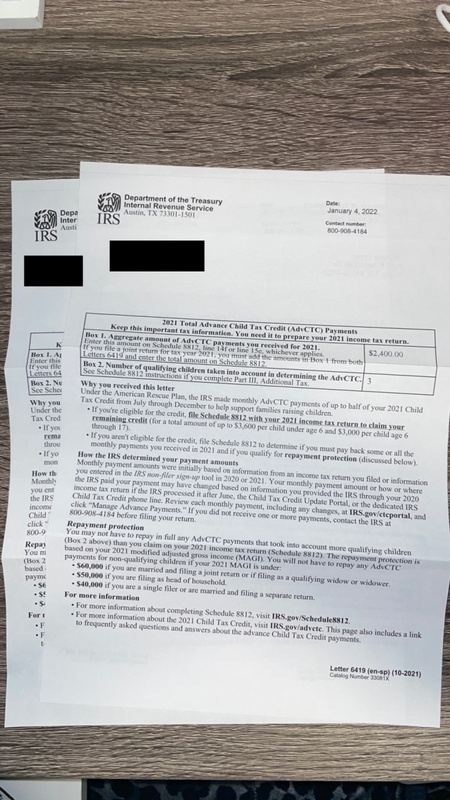

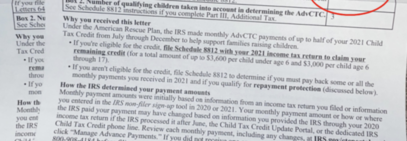

Instead that envelope you’ll find Letter 6419. This letter contains information for your 2021 Total Advance Child Tax Credit Payments (AdvCTC). This is the letter you want to double check with your records because it will be what the IRS claims they sent you in payments (if eligible) monthly from July – December for having kids.

The IRS Letter 6419 looks like this:

Here’s where it gets confusing…

Why are we receiving 2 child tax credit letters?

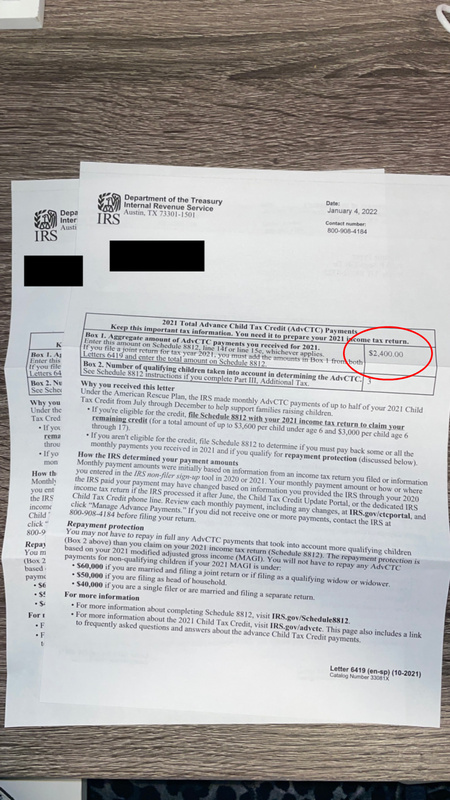

So, the first thing I noticed was that, my husband and I each received one of these letters. One in his name, one in my name. Both with the EXACT same information. I was confused at first because we file together as married filing joint. So, why not just put the letter in one name?

The second thing I noticed was, the amount wasn’t correct for 1 single letter. For example, our household qualified for the max monthly child tax credit payments which was $800 a month for our two children. Well, $800 a month x 6 months (July – December) comes out to $4,800 NOT the $2,400 that is on this letter.

SO… what I concluded was that, the tax credit is being split among the tax filers. $2,400 is reported for me and $2,400 is reported for my husband. This is why there are two letters. $2,400 x 2 = $4,800 which was the max for the 2021 year.

The letter also has information on how to file schedule 8812 with your 2021 income tax return to get the remaining child tax credit (if eligible).

The reason I am telling you this is because you DO NOT want to throw one letter away thinking one letter has the correct information because it doesn’t.

Even if you are divorced but share children, you’ll want to tell the other parent about this so they can file their letter with their taxes too. Half of the credit seems to apply to each parent.

Because if you don’t file this correctly, you will be getting a surprise tax bill from the IRS once they realize your claimed they didn’t send these payments but they really did (and you already got the money). Nobody wants that.

If you happen to be a single parent (as in the other parent is completely out of the picture) this two letter thing probably won’t apply to you.

Truthfully, I don’t know why the IRS has to make filing taxes even more complicated but it is important to know.

And don’t forget, you will get another letter – – form 6475 and that letter will tell you what you received in stimulus money. I have no idea yet if that’ll be one or two letters but just keep your eyes peeled.

I hope this helps make tax filing a little bit easier this year because I feel like things are going to be 10x harder this year. Good luck!

Great. Post an article and ignore the comments.

Hello. I getting this today but i dont have children.

Any update on if you received two letters 6475. I only have one and it doesn’t have my husband’s name on it so I’m confused if the out I’m inputting is correct or not.

My husband and I file together also but he has no income, do you think that the splitting of the payments still apply?