The IRS Will Soon Be Sending You Two Letters You Cannot Throw Away. Here’s What You Need To Know.

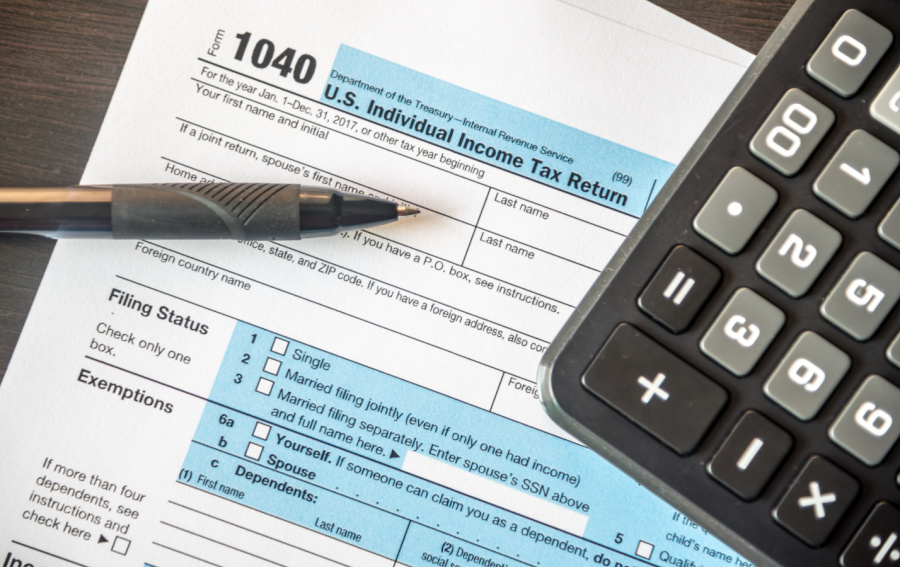

The year is officially coming to an end and that means that tax season is right around the corner.

With that being said, you’ll want to keep an eye on your mail and you won’t want to throw away anything without reading this first.

Why? Because The IRS Will Soon Be Sending You Two Letters You Cannot Throw Away. Here’s What You Need To Know.

In case you’ve forgotten, we all received stimulus checks back in March so one of the letters will be this amount that you’ll need to have handy when you file your taxes.

This letter is form 6475 and that letter will tell you what you received in stimulus money. Now, you might already know what you received BUT you do want to compare records with the letter to ensure the IRS sent you the same amount you received.

If the amounts are different, you’ll need to file this information along with your 2021 taxes in the 2022 tax filing season.

The second letter is form 6419 and this will tell you what you received in the monthly advanced child tax credits.

You will want to have both of these letters handy when you file your taxes. Having this information and ensuring it is correct, will help you process your tax return much faster come this next tax season.

These letters will start being mailed out on January 19, 2022 so make sure you don’t throw anything away with double checking it first.

Oh and in case you’re wondering, the first day to file your 2021 taxes is January 27, 2022 which is the official day the IRS opens.

Hope this helps get your taxes filed sooner and easier! You can read more about these letters on the IRS website here.