A New Federal Rule Will Cap Most Credit Card Late Fees at $8. Here’s What We Know.

This makes my broke self a bit more happy this morning. I dread using credit cards, but right now it’s almost impossible to get by without them.

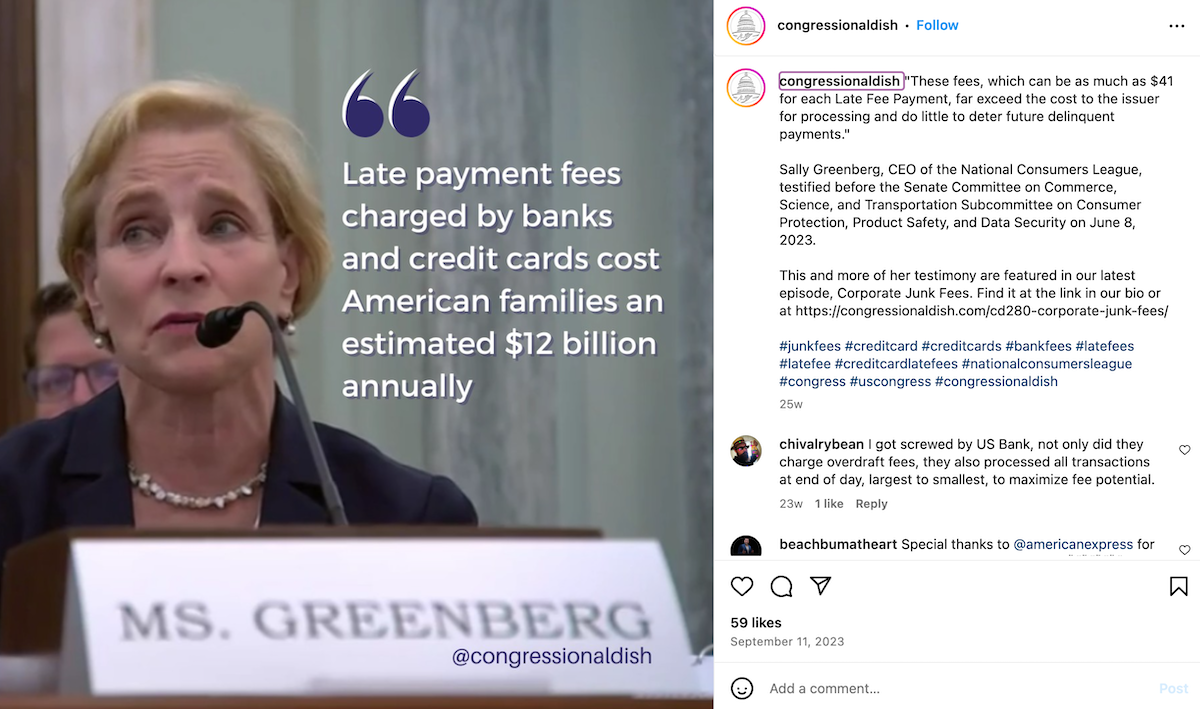

The average credit card late fee is about $32, with this new cap at $8 it could save people so much money.

I’ve always questioned how having such high late fees could ever allow someone truly in debt to climb out of that sinking hole.

Things happen, I’m not talking about just choosing not to pay your bills, but real-life emergencies happen.

Trust me, I am no fan of our current economy and we are all struggling, but this could help some of us out a bit. For true change, we will need a lot more to happen though.

This new rule will apply to credit card issuers that have more than 1 million accounts. Not all credit card companies will have to abide by the new rule.

For over a decade, credit card giants have been exploiting a loophole to harvest billions of dollars in junk fees from American consumers. Todays’ rule ends the era of big credit card companies hiding behind the excuse of inflation when they hike fees on borrowers to boost their own bottom lines.

CFPB Director Rohit Chopra said in a statement

Pretty much everyone I know is having to use credit cards just to cover the minimal basics of life right now. There is also a proposed rule to take on the crazy overdraft fees and I hope that one gets approved as well.

The rate of inflation is draining everyone and Americans are struggling, we have exceeded $1.1 TRILLION in credit card debt!

The new rule is expected to take effect on June 1st, 2024.

Some argue that this will cause more people to not pay their debt. I disagree because those people would do that anyhow.

However, this will help those of us who are trying and just can’t make a dent due to the excessive late fees. What are your thoughts?