Have A College Student? You May Be Getting A $500 Payment Next Month

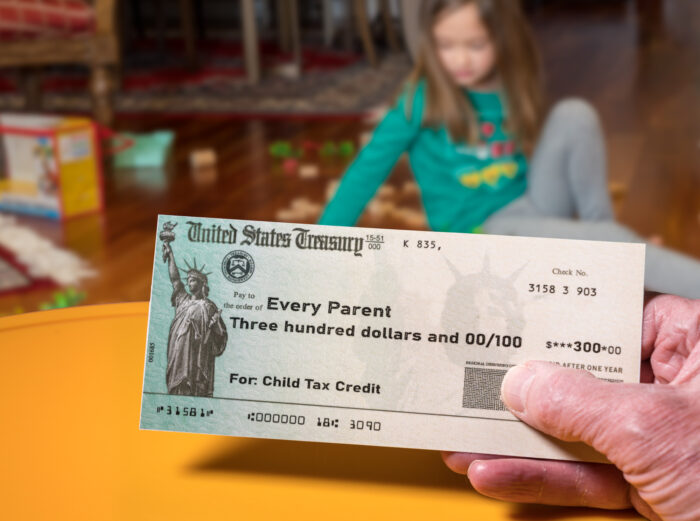

By now you are probably aware of the child tax credit and what that means for parents of children 17 and under. It results in monthly cash payments through the end of the year.

And if you have a college student you may be wondering if that means you’ll get any payment for them at all and the short answer is, yes.

According to The American Rescue Act, The Child Tax Credit will provide a one-time payment of up to $500 for 18-year-olds and those aged 19-24 who are full-time college students.

For example, if you have two children who are both in college, you could receive up to an extra $1,000 in child tax credit benefit.

So, how do you know if you qualify?

If your adjusted gross income is $75,000 or less as a single filer, $112,500 as a head of household or $150,000 filing jointly, you will get the full $500 for each eligible child who is a college student.

If your income is higher than the income threshold, your payments will begin to phase out and decrease by $50 for every $1,000 of income over the threshold. These thresholds apply for each age group and for each varying benefit amount.

If you do not normally file a tax return, or claim “non-filer” status, you can still receive these benefits.

The IRS has set up specific portals for these individuals to input their information and register for child tax credit availability. This specific portal is said to be up and running by the end of this week or next. The portals can be found here.