Here’s The List of Schools That May Be Getting Student Loans Canceled

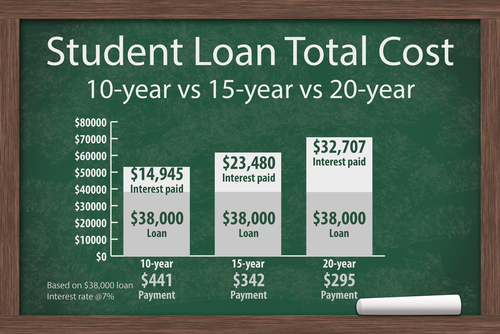

Student Loans are that thing almost nearly everyone has yet nobody wants.

From a young age we are taught that going to school to get a higher education is important and that obtaining student loans to accomplish that, is normal.

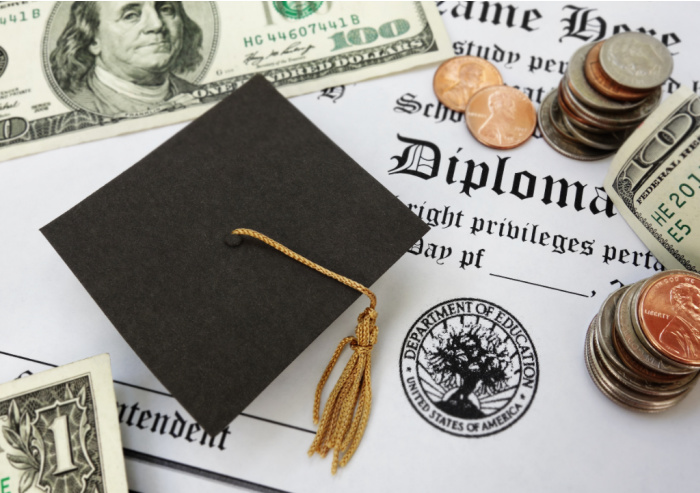

But what happens when the school you go to is predatory and tricks you into obtaining thousands in student loans but leaves you with a useless degree and empty promises for future career opportunities?

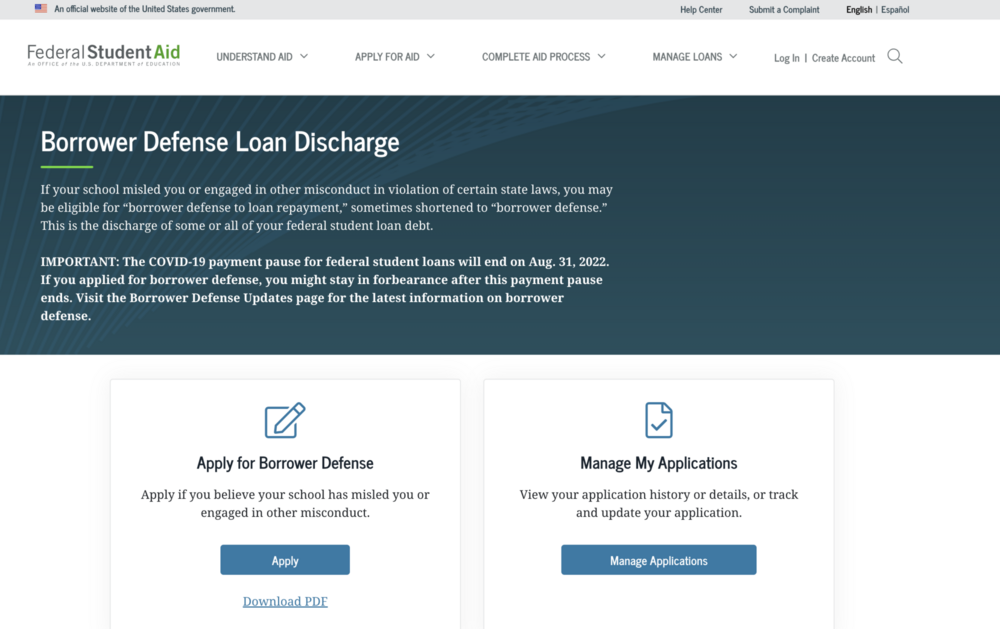

This very thing has happened to millions of people and now, there is an on-going lawsuit that is trying to help get student loans canceled under the borrower’s defense loan discharge.

The List of Schools That May Be Getting Student Loans Cancelled

There is currently a list circulating around the internet with people stating it is a list of schools getting student loans canceled (see the list below).

So, what does all this mean? Are student loans actually getting cancelled if you attended any of these schools?

The short answer is, it is likely you’re student loans will get cancelled if you attended one of these schools.

However, even if you didn’t attend one of those schools on the list, if you put in a borrower’s defense application prior to June 22, 2022, you may be getting them canceled.

As of right now, there is a lawsuit titled PROPOSED SETTLEMENT IN SWEET V. CARDONA (FORMERLY SWEET V. DEVOS).

The lawsuit was made after thousands of people realized their borrower defense applications were not being approved, denied or even looked at.

My husband is one of the many people that this has happened to. We put in an application back in May 2019 on a school he attended that closed after predatory actions and have yet to hear back.

The lawsuit has been on-going and is currently in the final stages. According to the Predatory Student Lending website:

On June 22, 2022, the parties in this case filed a proposed settlement agreement with the court. The court will hold a hearing on whether to grant preliminary approval to that settlement on July 28, 2022. If preliminary approval is granted, the Department of Education will send individual notice to all class members with additional information. Class members will have an opportunity to comment on the agreement.

The proposed settlement sets out procedures for resolving the borrower defense applications of everyone who had an application pending as of June 22, 2022. In short, class members who took out loans for attendance at certain schools will automatically receive loan discharge, refunds, and credit report adjustments. Class members who attended other schools will receive decisions on their borrower defense applications within a set timeline, depending on how long their applications have been pending. The Department will rescind all of the denial notices it issued between December 2019 and October 2020.

Do you have to do anything to be included?

No. If you had a pending borrower’s defense application prior to June 22, 2022, you are automatically included and do not need to do anything right now.

Keep in mind this DOES NOT include any private student loans and is only for federal student loans.

As of right now, the best thing you can do is, cross your fingers and wait until the decision is made on July 28, 2022.

You also don’t need to be making any payments during this time and should see a pause on your interest and payments during this settlement agreement period.

What Schools Are Getting Student Loans Cancelled?

The list of schools that may be getting student loans canceled are: