President Biden Just Signed The ‘Inflation Reduction Act’. Here’s Everything You Need to Know.

Americans everywhere are looking for relief right now. With the rising costs of nearly everything, families are struggling to make ends meet.

Well, there may be *some* relief in sight as President Joe Biden has just signed the Inflation Reduction Act.

🇺🇸 Everything You Need to Know About The Inflation Reduction Act

The Inflation Reduction Act was prepared as a way to reduce costs for Americans and try to elevate future rising costs on everyday expenses such as healthcare, medications, and provides tax credits to help with energy costs.

It Lowers Medication Costs

Under the Inflation Reduction Act, Medicare will have the power to negotiate for lower prescription drug prices. Seniors will pay less for drugs and won’t pay more than $2,000 for out-of-pocket costs in a year.

This is no matter how many prescriptions they have including medications/treatments for cancer.

It lowers healthcare insurance premiums

In addition the $2,400 savings through the American Rescue Plan signed last year, under the IFA, there will be lower healthcare premiums for millions of families who get their coverage under the Affordable Care Act.

Thirteen million people will see average savings of $800 a year.

It will provide energy savings costs and tax credits

In an aggressive approach to confronting climate crisis, Americans will receive thousands of dollars in savings by providing them rebates to buy new and efficient appliances and weatherize their homes, and tax credits for heat pumps and rooftop solar. It gives consumers a tax credit to buy an electric vehicle or fuel cell vehicle — new or used — up to $7,500 if that vehicle was made in America.

There will also be tax credits that will create thousands of good-paying clean energy manufacturing jobs on solar projects, wind projects, clean hydrogen projects and carbon-capture projects across the country.

Now you might be wondering where the money for this is coming from and according to the statement made by President Biden…

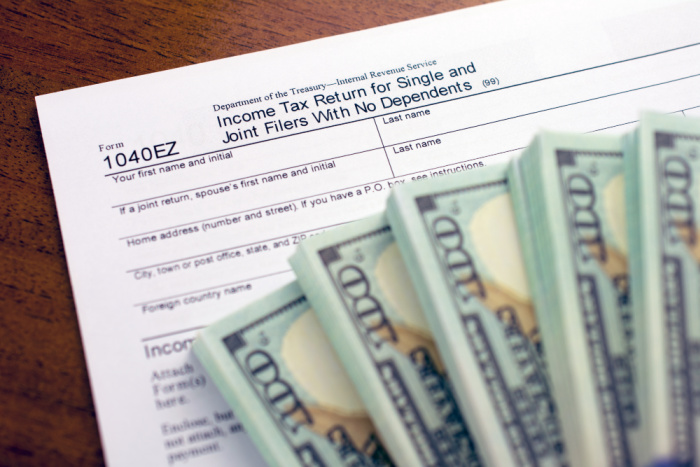

Democrats voted to cut the deficit to fight inflation by having the wealthy and big corporations pay their fair share. However, every single Republican opposed requiring big corporations to pay a minimum tax of 15%.

According to President Biden, under the act, corporations will now pay a minimum of 15% in taxes.

He also mentioned that no one earning less than $400,000 a year will pay a single penny more in federal taxes.

Now, many believe this won’t have an immediate impact on costs, others believe we will begin savings on many of these fronts by November when mid-term elections happen.

So, hang in there and cross our fingers that relief is coming!

You can watch the announcement of what was signed below.