Here’s How to Complete The New IRS W4 Form Because Nearly Everyone is Confused

I swear taxes shouldn’t be this complicated.

If you are someone who feels like they just got a handle on doing their own taxes, I’m sorry to inform you – there’s been a change to the IRS W4 forms for 2023.

And it’s no surprise that the new form is completely confusing people.

Many are not realizing that, there’s a box to check if you have a two income household and if you miss checking that one tiny box on the form, you could end up overpaying in taxes and nobody wants that.

P.S. I am not a tax professional and this is not tax advice. However, I’ve gathered information from the internet to share it with you to hopefully help you complete the new W4 form.

What is a W4 Form?

A W4 form is an IRS form everyone completes with their employer so their employer can withhold the correct federal income tax from your paychecks.

Who should complete the new 2023 W4 form?

According to the IRS website:

Consider completing a new Form W-4 each year and when your personal or financial situation changes.

This also includes anytime you start a new job or receive an increase/decrease in pay.

Why is it important to fill out the W4 form correctly?

If you don’t complete the W4 form correctly, your withholdings for taxes could be wrong. This can result in owing more taxes and receiving less of a federal refund for the following tax filing season.

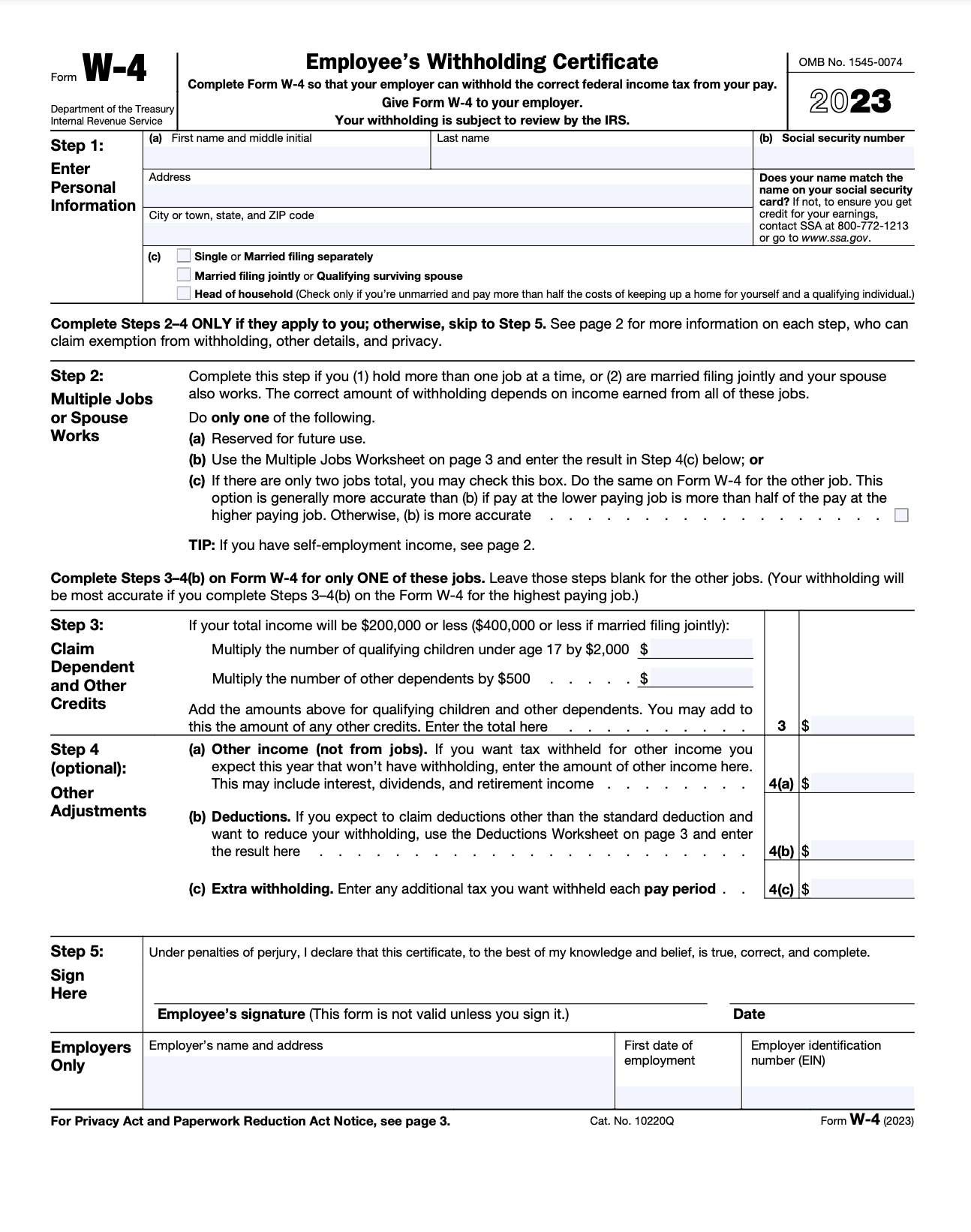

How to Complete the New 2023 W4 Form

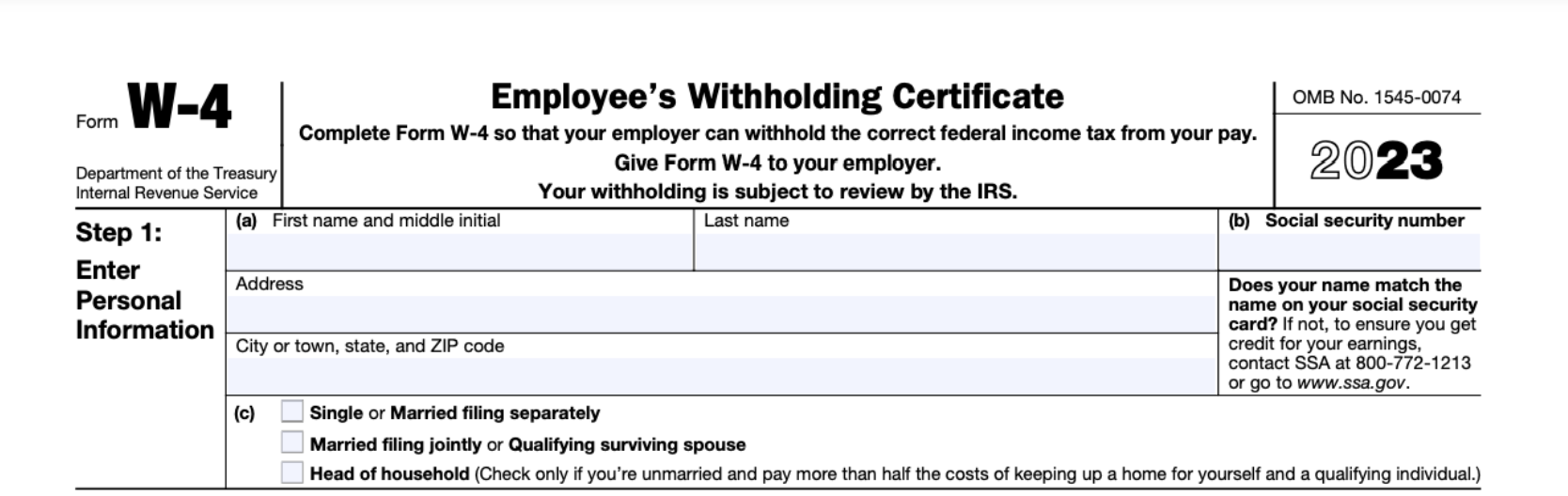

Below is what the new IRS W-4 form looks like for 2023. It is available through your employer or you can find it directly on the IRS website here.

Now let’s break down each section step-by-step.

In the first section, it’s pretty self-explanatory and just like previous W4 forms. Start by entering your name, social security number, address and the way you file your taxes.

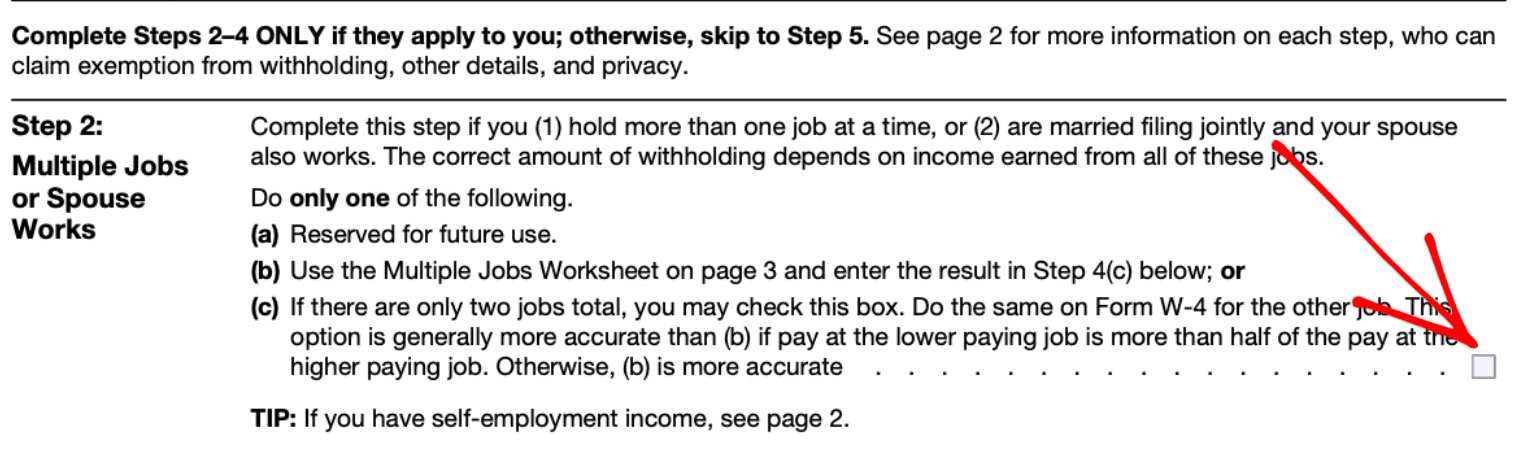

In step 2 – This is where people are getting confused.

In this step you will see this info “Complete this step if you (1) hold more than one job at a time, or (2) are married filing jointly and your spouse also works. The correct amount of withholding depends on income earned from all of these jobs.”

This means if both you and your spouse work OR you have two jobs at the same time, and any of the situations in step 2 apply to you, you can choose ONE of the steps.

Now, if there are only two jobs total (where it’s you personally or you and your spouse), you can check that teeny tiny box. You would also need to make sure your spouse with the other job, checks that box too.

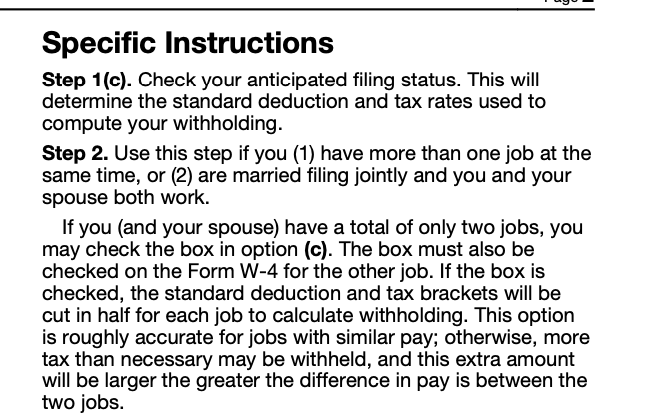

On page two of the IRS form it says:

Use this step if you (1) have more than one job at the

same time, or (2) are married filing jointly and you and your

spouse both work.

If you (and your spouse) have a total of only two jobs, you

may check the box in option (c). The box must also be

checked on the Form W-4 for the other job. If the box is

checked, the standard deduction and tax brackets will be

cut in half for each job to calculate withholding. This option

is roughly accurate for jobs with similar pay; otherwise, more

tax than necessary may be withheld, and this extra amount

will be larger the greater the difference in pay is between the

two jobs.

SO, this means IF you and your spouse have a huge difference in pay (like one spouse makes more than the other) you should NOT check this box.

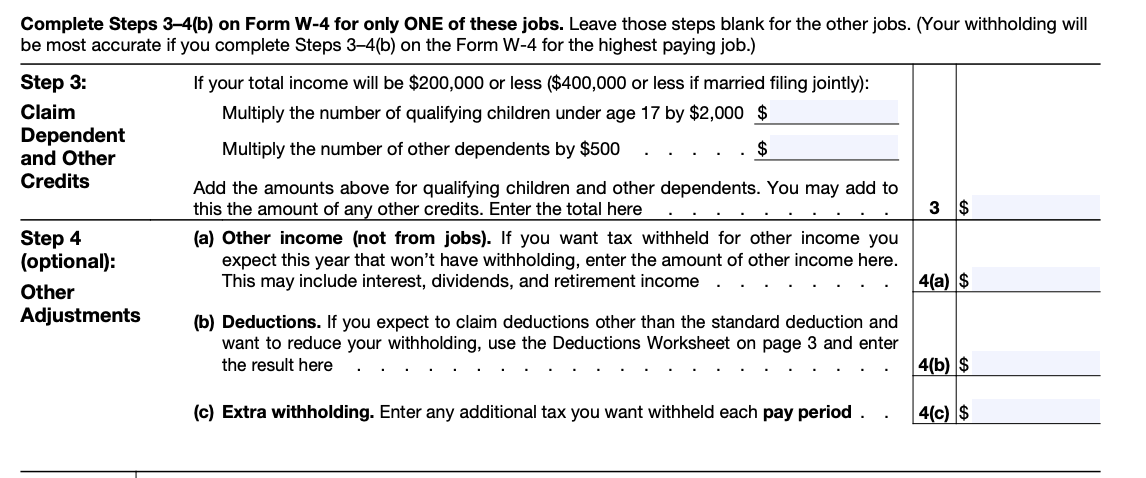

Steps 3 and 4 only need to be completed if these apply to you and your household (such as you have dependents)

On page 2 it states:

Multiple jobs. Complete Steps 3 through 4(b) on only

one Form W-4. Withholding will be most accurate if

you do this on the Form W-4 for the highest paying job.

So, you’d want to complete these steps on the highest earning spouse’s W4 form only.

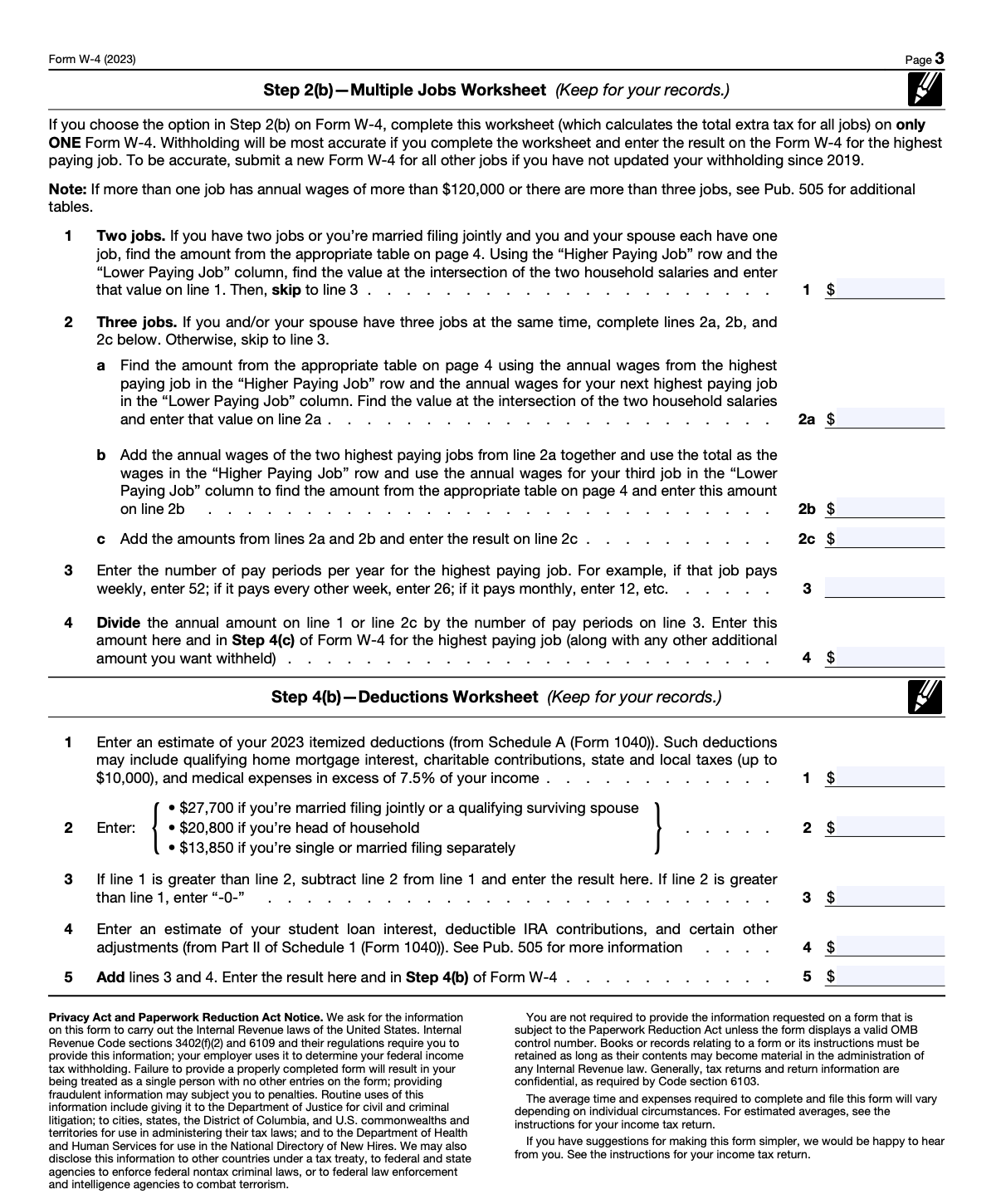

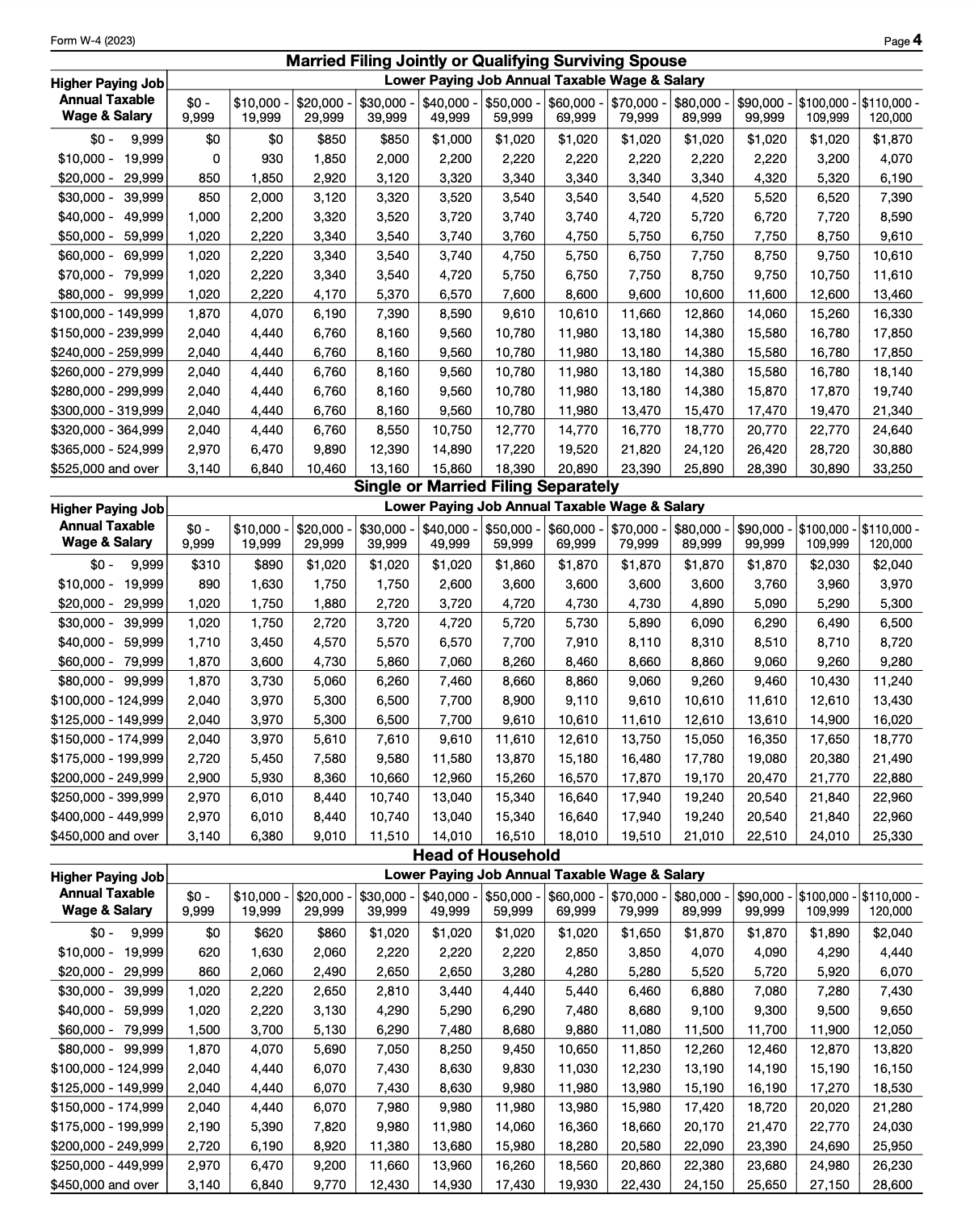

Pages 3 and 4 of the IRS W4 form give a chart and instructions on how you can more accurately calculate your tax withholdings based on your household item so those are worth taking a look at.

Again, this all seems very confusing but the best way to accurately complete this form is to ask your employer for help and/or ask your tax professional on the BEST way to complete this form for your tax situation.

You can also refer to the new W-4 Frequently Asked Questions published by the IRS, which provides additional guidance on whether you should update your W-4 form.

Below is an awesome YouTube video that also goes over this new W4 form in it’s entirety. Good luck!