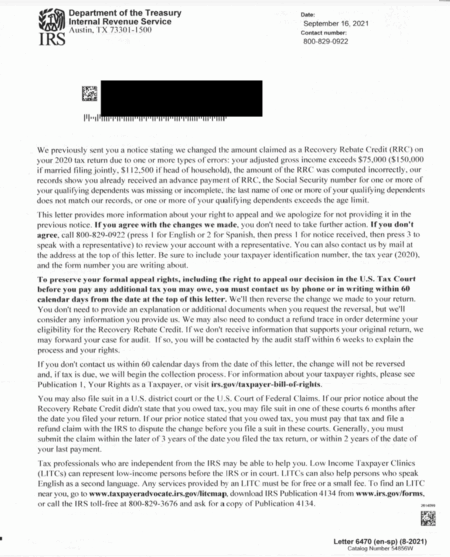

People Are Getting Letters From The IRS Regarding Their Stimulus Checks. Here’s What It Means.

If you’ve recently received a letter from the IRS regarding the Recovery Rebate Credit (RRC) pertaining to the stimulus checks you received, you might be freaking out.

I say this because I was freaking out too. That is, until I realized what it was all about.

So, if you received the letter like picture below, here’s what that means.

When you filed your taxes in 2021 for 2020, you may have clicked the box that told the IRS that you did not receive all or some of your stimulus checks. This was known as the Recovery Rebate Credit.

Basically, if you did not receive your last stimulus check, you may have received a credit in the form of a tax refund for that amount.

This letter is basically saying that after your taxes were filed, they realized that the IRS did actually give you all of your stimulus checks so you did not actually qualify for that recovery rebate credit.

What happened is that so many people had filed their taxes saying they didn’t receive their 3rd stimulus check due to a delay, then that check was sent but the taxes has already been filed.

This letter is inform you of that change and basically, if you agree with them, you don’t have to do anything and they’ll contact you via mail if you owe them anything.

Now, if you don’t agree with them and you did in fact qualify for the RRB and did not receive some or all of your stimulus checks, then you need to contact the IRS to tell them their calculations are wrong.

Either way, don’t panic too much over this letter. Just make sure you are aware because you have 60 days to contact the IRS from the date of the letter if you don’t agree.

Photos courtesy of Deposit Photos.