Here’s How To Get Your Stimulus Check By Direct Deposit

As you’ve all probably heard by now, the government has approved the Stimulus Check to help our Americans. But that has now issued the question, “when can I expect my stimulus check?”.

Well, now there is something additional information to answer that burning question.

First off, who qualifies for the stimulus check?

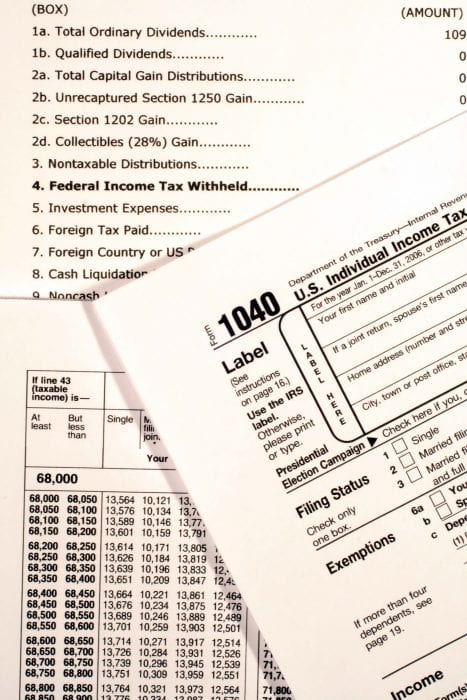

According to the IRS, it is based on income.

If you made less than $75,000 in 2019, you will be eligible for the full payment of $1,200. Couples who filed jointly and made less than $150,000 will get $2,400. An individual who filed as “head of household” and earned $112,500 or less gets $1,200. For every child in the household, you will receive an additional $500.

How will the stimulus check eligibility be calculated?

The IRS says it will use people’s 2019 returns to calculate eligibility and automatically send the money to those who qualify. If they haven’t filed a 2019 return, it’ll be based on the 2018 return.

How can I ensure I get the check the fastest way possible?

According to the IRS website:

The distribution of economic impact payments will begin in the next three weeks and will be distributed automatically, with no action required for most people. However, some seniors and others who typically do not file returns will need to submit a simple tax return to receive the stimulus payment. Please do not call the IRS about this. When more specific details become available, we will update this page.

Therefore, the FASTEST way to ensure you get your stimulus check is to ensure your 2019 or 2018 taxes have been filed so you can get it via direct deposit.

Also, you need to ensure that the banking information on those returns, is accurate since the IRS is planning to directly deposit the checks into the same account.

The economic impact payment will be deposited directly into the same banking account reflected on the return filed.

So, what do you do if you no longer have access to that bank account?

According to the IRS website:

In the coming weeks, Treasury plans to develop a web-based portal for individuals to provide their banking information to the IRS online, so that individuals can receive payments immediately as opposed to checks in the mail.

BUT TurboTax has also launched an online tool where you can go and input your banking info so they can deposit your check into your account.

Bottom line is – if you’ve filed 2018 and 2019 taxes and your banking information is correct from those returns, you don’t need to do anything else besides watch your bank account over the next few weeks!

You can check out all the information directly on the IRS website here.

I received my stimulus check by U. S. Mail; however, I would like to receive any further amounts by direct deposit. How do I change my receiving method.

Can they put my stimulus check into my government Child Suppirt card?. Since deposits do get made to that card.

where my check

Were is my check I’m on ssi

Can it sent on my direct deposit Mastercard account for ssi

I read somewhere were there checking into whether the government will deposit it onto the Emerald Card you got when you file taxes I will update with you if I find anything further

So I did my taxes with liberty tax and I had a check sent to them for my tax refund. So will mine get sent to them or do I have to sent my bank info in somewhere

I used h&r block to file but I used and h&r block card to get my refund will the its deposit it to my h&r block emerald card