People Are Throwing Away Their Stimulus Checks Thinking It’s Junk Mail. Here Is What We Know.

STOP! Before you throw away that junk mail, make sure it isn’t your stimulus money!

If you are one of the 4 million people who has not yet received their stimulus money, you may be getting your “check” in the form of a debit card.

This will be issued by Money Network Cardholder Services, and some are confusing it with junk mail. That is NOT good, since each card can hold up to $3400 for a family of 4.

The government opted to start sending debit cards that have been loaded with the stimulus money, instead of paper checks. Those that will receive this card include people for which the government does not have your bank account information.

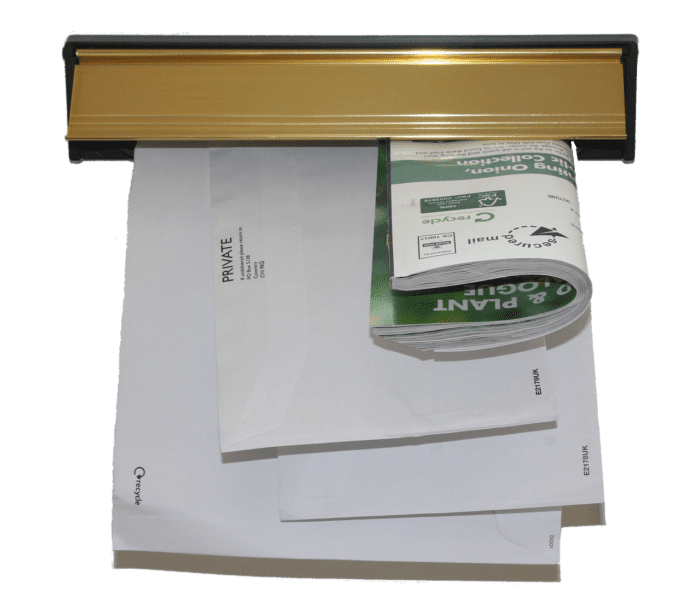

The confusion is coming, because these debit cards are getting sent in a plain white envelope — which resemble the 4 bazillion credit card offers we get in the mail.

People are tossing the envelope in the trash, before they even look at what’s actually inside.

To help taxpayers identify the cards, the IRS said in an FAQ that they will bear the Visa logo and are issued by MetaBank. A letter included with the cards explains that they are the Economic Impact Payment Card. More information is available at eipcard.com.

Yahoo! News

Once you establish that you have actually received a card containing you stimulus money, the card needs to be activated by calling the number found in the included paperwork. It can then be used like a regular debit card.

BUT — and this is important — in order to use the debit card, you CAN’T throw it away. Look at that envelope you are throwing out, and make sure it is, indeed, not your stimulus money!

Once you get your card, you want to be careful how you use it. Make sure you know the rules and fees associated with the card. The card can be used like a regular debit card, for free.

BUT — there are some fees, including a $2 withdrawal fee after the first withdrawal. Want a balance inquiry? That will take 25 cents off the card. It will also charge you $5 if you try to make more than one in-person withdrawal.

It is also important to note, you may not withdraw more than $1000 in any one day. Plan accordingly.

Bottom line — don’t accidentally throw out your stimulus debit card. Also, know the fees associated with your card, so you don’t lose more money than you intend.

Not only did the darned envelope look like junk mail, they had my name wrong! I didn’t change my last name when we married but there was my first name with his last name on a phony looking debit card. Of course, we cut it up and tossed it! We’ve since called the customer service number and had it replaced, but the person we spoke to on the phone said that having my name that was was deliberate on the part of the IRS! They deliberately put my wrong name on a debit card worth a lot of money! WTH?

Why didn’t everyone get one bc sure would of been hell of a lot easier for me bc I can’t cash my check because husband isnt willing to let me have my part along with our two boys so now it’s not going to be cashed so we screwed on that.