You Have Just A Few Days To Opt Out For July’s Monthly Cash Payment For Parents

It’s the moment you’ve been waiting for…

As you may know by now, the IRS is ready to start sending the monthly cash payments to parents beginning July 15, 2021.

Since the announcement was made, many have wondered if they’d qualify or how they could go about opting out of the monthly cash payment.

Now, you might be wondering WHY someone would want to opt out and basically, if you are someone that typically OWES at tax time, you may want to opt out since that will less the amount of credit you receive in 2022 when you file your 2021 taxes.

With that being said, as of today, the The IRS Has Opened The Portal For Parents To Opt Out Of The Monthly Cash Payments.

Now, it’s important to note that IF you’ve filed your 2019 or 2020 taxes, you really don’t need to do anything. You will automatically receive the money.

“Most families will begin receiving monthly payments automatically next month without any further action required,” the IRS said.

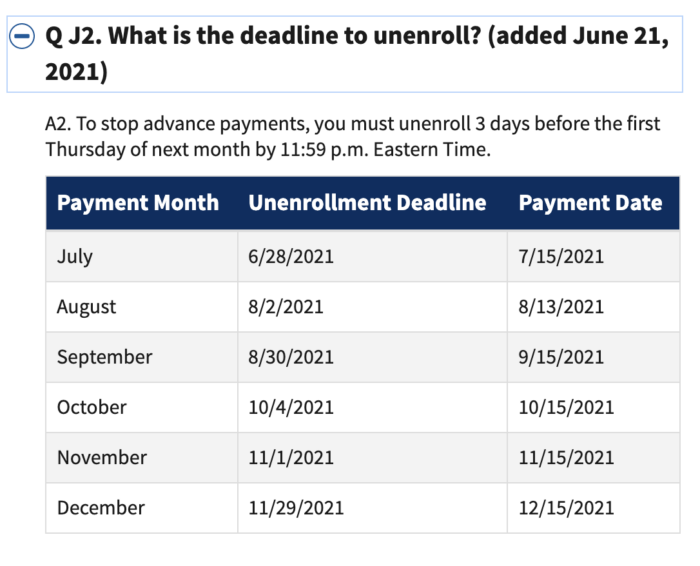

If you want to opt OUT of the monthly payments, you need to go to the portal on the IRS website and complete the form to do so. You have until June 28, 2021 to opt out for July’s payment (other opt out dates are below).

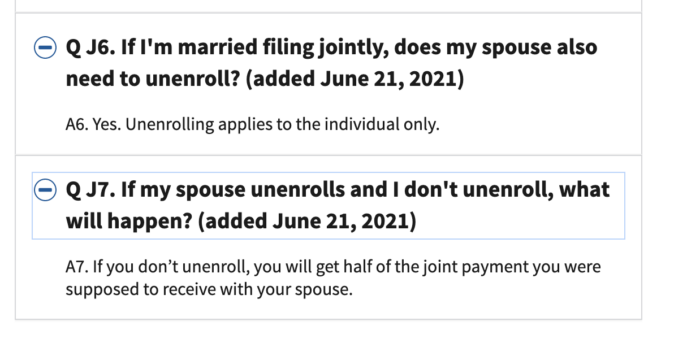

You also need to do this for both you and your spouse.

All you need to do is head over and click “Unenroll From Advance Payments” (blue button).

You will then need to create an account or login using your existing IRS account and complete the form.

You will then be opting out of receiving the monthly cash payments for July-December 2021 and will receive the full tax credit in 2022.

Here are the opt out deadlines:

So, if you opt out AFTER June 28, 2021 you will receive July’s monthly payment and won’t be unenrolled until the next payment in August.

You can access the IRS Child Tax Credit Tool Here.

Photos courtesy of Deposit Photos.