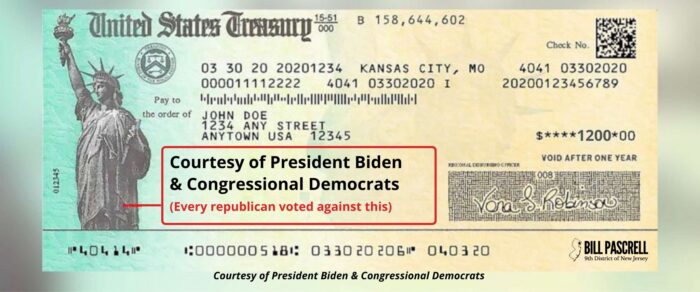

If You Haven’t Received Your Child Tax Credit Payment, Here’s What You Need To Do.

As you may know, July was the first month that eligible parents would receive the child tax credit payment.

July 15, 2021 was the first official date these payments were being sent but many payments went out days before.

Now that we are about a week out from that date, many are realizing they still have not received their payments. So, what is going on?

For starters, keep in mind that payments either were direct deposited or were delivered in a check by mail.

If you received your stimulus checks by direct deposit, it does not mean you will have these child tax credits delivered the same method.

In fact, I had direct deposit for my stimulus payments but this child tax credit came via a check in the mail.

So, If You Haven’t Received Your Child Tax Credit Payment, Here’s What You Need To Do.

Make sure you qualify. The IRS is basing eligibility on the most recent tax return it has on file, and some households may have earned too much to get the money.

If you’re a single parent, you’ll receive the full per-child amount if your adjusted gross income (total income minus a few deductions) is under $75,000. For married couples who file joint returns, the income cutoff for maximum benefits is $150,000.

If you are divorced, the person who claims their child will receive the payment if eligible.

See if you need to submit a tax return. Those who typically don’t file their taxes or are running late this year will want to file a return quickly to provide the IRS with the up-to-date information it needs to disburse the child credit cash.

Check the portal. The IRS has launched an online portal so parents can update their address, bank account and other personal details required to receive their payments.

You can also check the portal to investigate the status of your payments and potentially get to the bottom of any holdups.

Make sure you haven’t been scammed. The IRS is warning Americans to be on the lookout for scams related to the child tax credit payments. The agency emphasizes that the only way to receive this benefit is to file a tax return or register online through its nonfiler sign-up tool.

It also reminds taxpayers that the IRS never sends unsolicited emails or texts instructing anyone to open attachments or visit nongovernment websites.