Yes, You Do Have To Pay Back Taxes From The Payroll Tax Cut. Here’s What We Know.

By now you’ve probably heard about the Payroll Tax Cut that has gone into effect as of a few days ago.

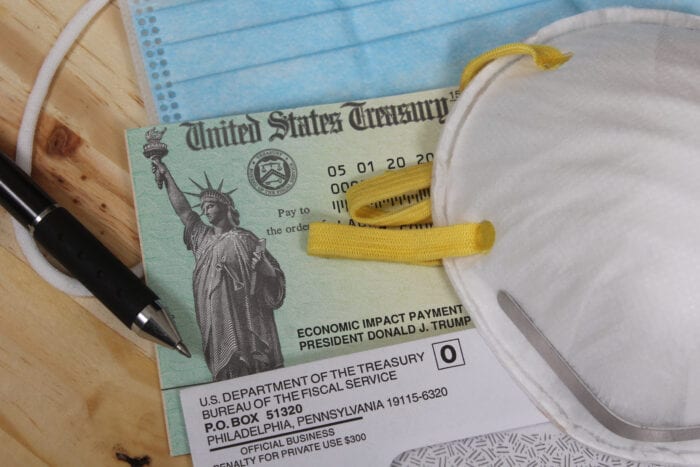

If you haven’t, it was an executive order by the President that would stop the collection of payroll taxes for people who make less than $104,000 annually. Essentially, it would put more money into the pockets of people NOW.

Employers can opt-out of this but if your employer does take part, there is nothing you can do about it.

The order is supposed to last from September 1, 2020 through the end of the year.

However, most don’t realize that this isn’t just free money. In fact, the taxes you don’t pay now, have to be paid next year which means you will be double taxed.

The United States Treasury gave additional information saying:

- It is up to the companies to decide if they will opt into the deferral.

- If companies opt to defer payroll taxes for employees, workers could get a bigger paycheck today, but they will have to pay it back by the end of April 2021.

- This only applies to people who get a bi-weekly check of less than 4,000.

The key phrase in their announcement is this:

For Affected Taxpayers, the due date for the withholding and

payment2 of the tax imposed by section 3101(a), and so much of the tax imposed by section 3201 as is attributable to the rate in effect under section 3101(a), on Applicable Wages, as defined herein, (collectively Applicable Taxes) is postponed until the period beginning on January 1, 2021, and ending on April 30, 2021.

That means all of the taxes from September 2020 – December 2020 have to be paid back by April of next year. Most employers will begin taking out double taxes in January to pay these taxes back.

This licensed accountant explains it better than I can:

” Listen to me save that money don’t blow it. You will need that money later on. You have to pay that money back one way or another which means your employer will take a higher percentage of payroll taxes from your paycheck starting January 1, 2021-April 30, 2021. Your paycheck will be significantly lower during that time period. Don’t get caught up in the hype that you have more money because in reality by the end of April 30, 2021 it balances out to being the same amount of money you would have made anyway without the cut. Don’t put yourself in debt because of this.”

So, the bottom line is, while it may seem like it was a good idea, it is just putting a bandaid on the situation. Come January, people will be in an even worse situation especially as many are facing job losses after the holiday season.

The best thing you can do is either a) have your employer take out taxes as normal b) put money aside for those taxes so come January you aren’t in a worse situation.

You can read all the information about the payroll tax cut here.