The IRS May Owe You $900. Here’s How to Check.

What could you do with an extra $900 right now? Chances are, a lot.

Well, turns out, the IRS may actually owe you $900 and there’s a simple way to check.

The good news is, you can easily check.

The bad news is, you need to do it fast as the time frame to claim this extra money, is coming close to the end.

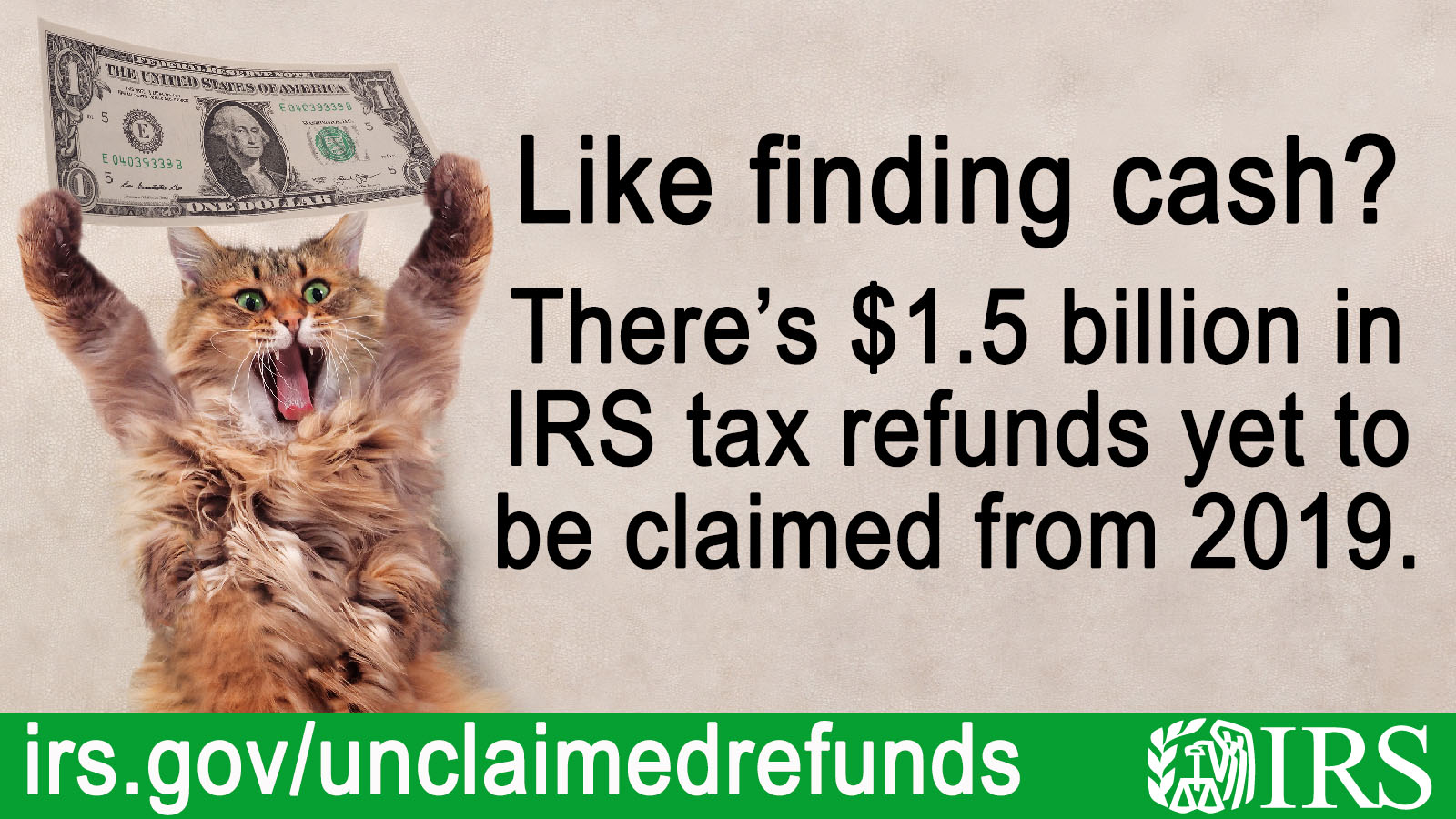

Last month, the IRS announced that nearly 1.5 million people have unclaimed refunds for tax year 2019 and estimated the total at $1.5 billion.

That means that the average refund is $893 (nearly $900).

The catch? In order to qualify for the refund, you need to submit your 2019 return by July 17, 2023.

The IRS is eager to get this money out to tax filers.

In fact, they even tweeted saying:

You’d normally have up to 3 years to claim a tax refund, but due to the pandemic, #IRS extended the deadline to file your 2019 tax return to July 17, 2023. If you didn’t file, don’t miss out.

IRS Twitter

How to Check if The IRS Owes You $900

All you need to do is, ensure you filed your taxes for 2019.

If you didn’t, you will need to file your 2019 tax return by the July 17, 2023 deadline.

The IRS issued Notice 2023-21 on Feb. 27, 2023, which provides legal guidance on claims made by the postponed deadline.

“The 2019 tax returns came due during the pandemic, and many people may have overlooked or forgotten about these refunds,” IRS Commissioner Danny Werfel said in an April 12 news release. “We want taxpayers to claim these refunds, but time is running out. People face a July 17 deadline to file their returns. We recommend taxpayers start soon to make sure they don’t miss out.”

What happens to the money if people don’t file and claim it? Well, the money becomes the property of the U.S. Treasury.

So, hurry and check to ensure you filed your 2019 taxes and if not, file to take ahold of some of that money!