$3,600 Cash Payments for Parents Will Start In July. Here’s Everything We Know.

If you are a parent and file taxes, listen up!!

As you may have heard by now, The American Rescue Plan that was signed into legislation included additional child tax credits.

This means that for 2020, eligible parents will receive monthly cash payments starting in July.

The IRS has confirmed that payments will begin going out in July as planned.

Under the plan, parents will receive monthly cash payments from July – December with the remaining amount given as a tax credit on 2022 tax filings.

With that being said, many are wondering just how much they will receive.

If eligible, parents will receive $3,000 annually per child aged 6-17 and $3,600 for kids under 6 for single parents earning less than $75,000 annually, $112,500 for head of households, and $150,000 for married couples.

But if you really want to know EXACTLY how much you will be getting, you can head over and use this online calculator and it will give you the exact amount.

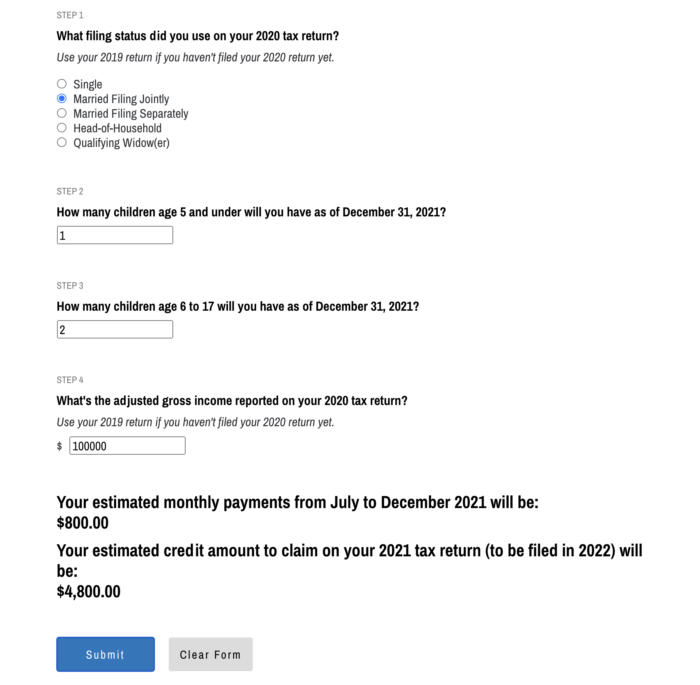

Now, keep in mind, you will need to have the exact information on your most recent taxes. You’ll need your AGI (adjust gross income), filing status, and the amount of dependents.

As an example, I completed the form using 1 kid under 5, 2 under 17 and then $100,000 as the AGI. It said I would receive $800 monthly from July to December.

You can use the online monthly cash payment calculator here.

What about parents that alter with the noncustodial parent and in 2020 didn’t get to claim their child as a dependent?