The IRS Says That Child Tax Credit Letter You Received May Be Inaccurate

I have to admit, I sort of saw this coming…

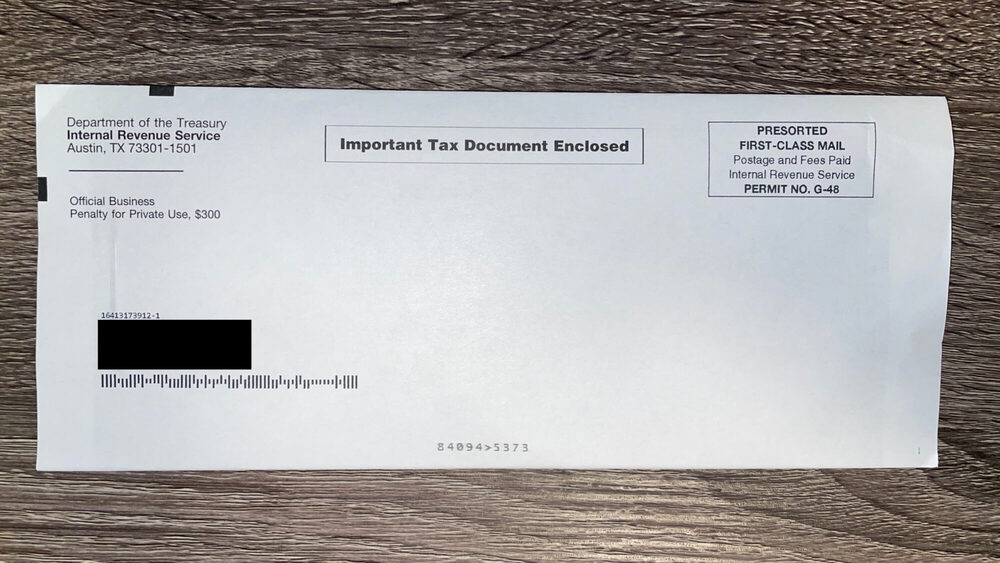

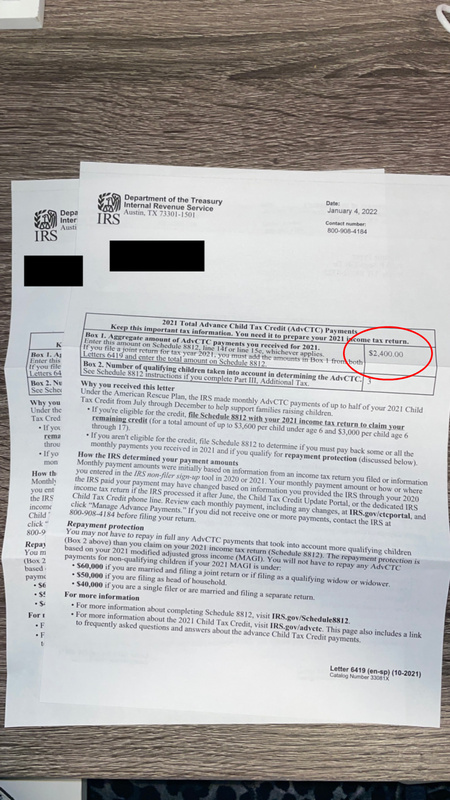

A few weeks back I had shared with you that there was a few important letters the IRS was sending you that you couldn’t throw away.

Well, some people received their child tax credit letter and it had some confusing information in it and now, the IRS is saying that letter may be inaccurate.

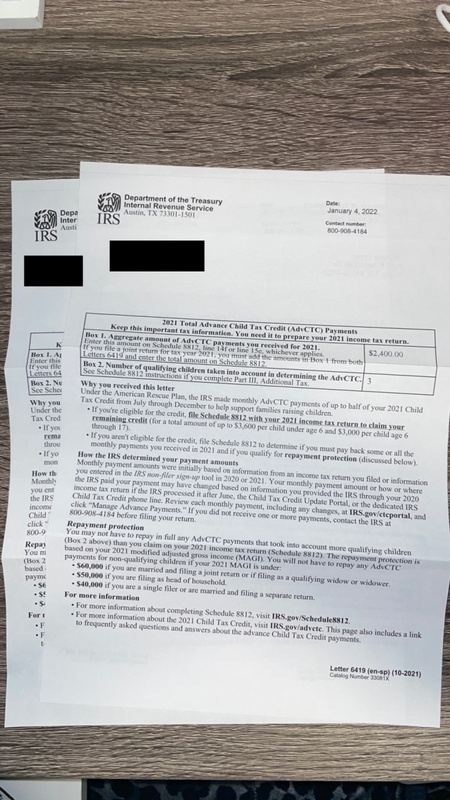

In case you don’t know by now, you will need to have form 6475 and form 6419 handy when filing your taxes this year.

However, it turns out, The IRS said it is reviewing complaints by some taxpayers who say that the IRS Letter 6419 sent to them spells out the wrong dollar amount for what the families received in 2021 for the advance payments of the child tax credit, which were issued each month from July through December.

YIKES.

I sort of knew something like this would happen. For starters, my letter was inaccurate as I didn’t receive one month of payments but the IRS says I did.

So, here is what you need to do:

Find the letter the IRS sent you. This is form 6419 and is specifically regarding the child tax credit payments. Look at the amounts the IRS says you received.

Then compare that number with the amount of child tax credit payments you actually received whether you had them direct deposited or a check that was cashed.

The IRS does say that don’t think it’s every single letter but they also don’t know how many letters are wrong.

So, if you think your letter is wrong, make sure you discuss that with your tax professional so you can get the remaining child tax credit that is owed to you. Otherwise, it could entirely delay processing of your taxes and tax return.